When it comes to saving for college, a 529 Plan stands out as one of the most popular and effective ways to ensure your child’s education is financially covered. But what exactly is a 529 Plan, and how can you make the most of it? Let’s break down everything you need to know about 529 Plans, from how they work to their potential benefits and drawbacks.

Understanding 529 Plans

What is a 529 Plan?

A 529 Plan is a tax-advantaged savings account designed specifically to help pay for education-related expenses. The name comes from Section 529 of the IRS tax code. The funds you contribute grow tax-free, and withdrawals are free of federal taxes when used for qualified education expenses.

Types of 529 Plans (College Savings vs. Prepaid Tuition)

There are two main types of 529 Plans:

- College Savings Plans: These are the most common type and work similarly to a retirement account, with investment options like stocks, bonds, and mutual funds.

- Prepaid Tuition Plans: These allow you to pay for future tuition at today’s prices, locking in current rates. They’re often state-specific and may not be available in all states.

Who Can Open a 529 Plan?

Anyone can open a 529 Plan—parents, grandparents, relatives, or even the student themselves. The key is that the funds are meant for the benefit of the designated beneficiary (usually the student).

Benefits of 529 Plans

Tax Advantages

One of the biggest perks of a 529 Plan is the tax benefits. Contributions are made with after-tax dollars, but the account grows tax-free. Additionally, many states offer state tax deductions or credits for contributions.

Flexibility in Use

Unlike other savings plans, 529 Plans offer flexibility on what they can cover. In addition to tuition, they can be used for books, supplies, and even room and board.

Potential for Growth

Because 529 Plans allow investments in things like stocks, bonds, and mutual funds, the money has the potential to grow over time, much like other investment accounts.

How 529 Plans Work

Contributions and Investment Options

You can contribute as little as $25 to $100 a month, depending on your plan. Funds can be invested in various options such as age-based or static portfolios. Age-based options adjust investments as the student nears college age, becoming more conservative.

How Earnings Grow

The funds grow tax-free based on the investment choices you make. If you opt for a portfolio with higher-risk, higher-reward investments, the potential for growth increases.

Distributions and Qualified Expenses

Distributions from a 529 Plan are tax-free if used for qualified education expenses like tuition, books, supplies, and even some room and board expenses. Non-qualified withdrawals incur taxes and a 10% penalty.

Choosing the Right 529 Plan

State-Specific Plans vs. National Plans

Each state offers its own 529 Plans, but you don’t need to stick to your home state. National plans, which are available across states, often have more investment options and lower fees.

Comparison of Fees and Expenses

Fees vary by plan, so it’s important to compare management fees, investment options, and any additional costs to ensure you’re getting the best value.

Investment Options and Performance

Look at how each plan’s investment options have performed historically. Choose a plan that aligns with your investment goals and risk tolerance.

Setting Up a 529 Plan

How to Open a 529 Account

Opening a 529 Plan is straightforward and typically involves filling out an online application or paper form. Once set up, you can start contributing regularly.

Naming a Beneficiary

You’ll need to designate a beneficiary (usually your child or a relative). You can always change beneficiaries if your child decides not to pursue higher education.

Choosing the Right Contribution Amount

Set realistic contribution goals based on your financial situation. Even small contributions can add up over time with the power of compound interest.

Using a 529 Plan for Different Types of Education

Higher Education (College Degrees)

Most people think of 529 Plans for traditional college expenses—tuition, fees, and housing.

Vocational and Trade Schools

529 Plans can also cover the costs of vocational schools, which are a great alternative for students pursuing technical or hands-on careers.

K-12 Education Expenses

Some states allow 529 Plans to be used for private K-12 education expenses, expanding their flexibility beyond college.

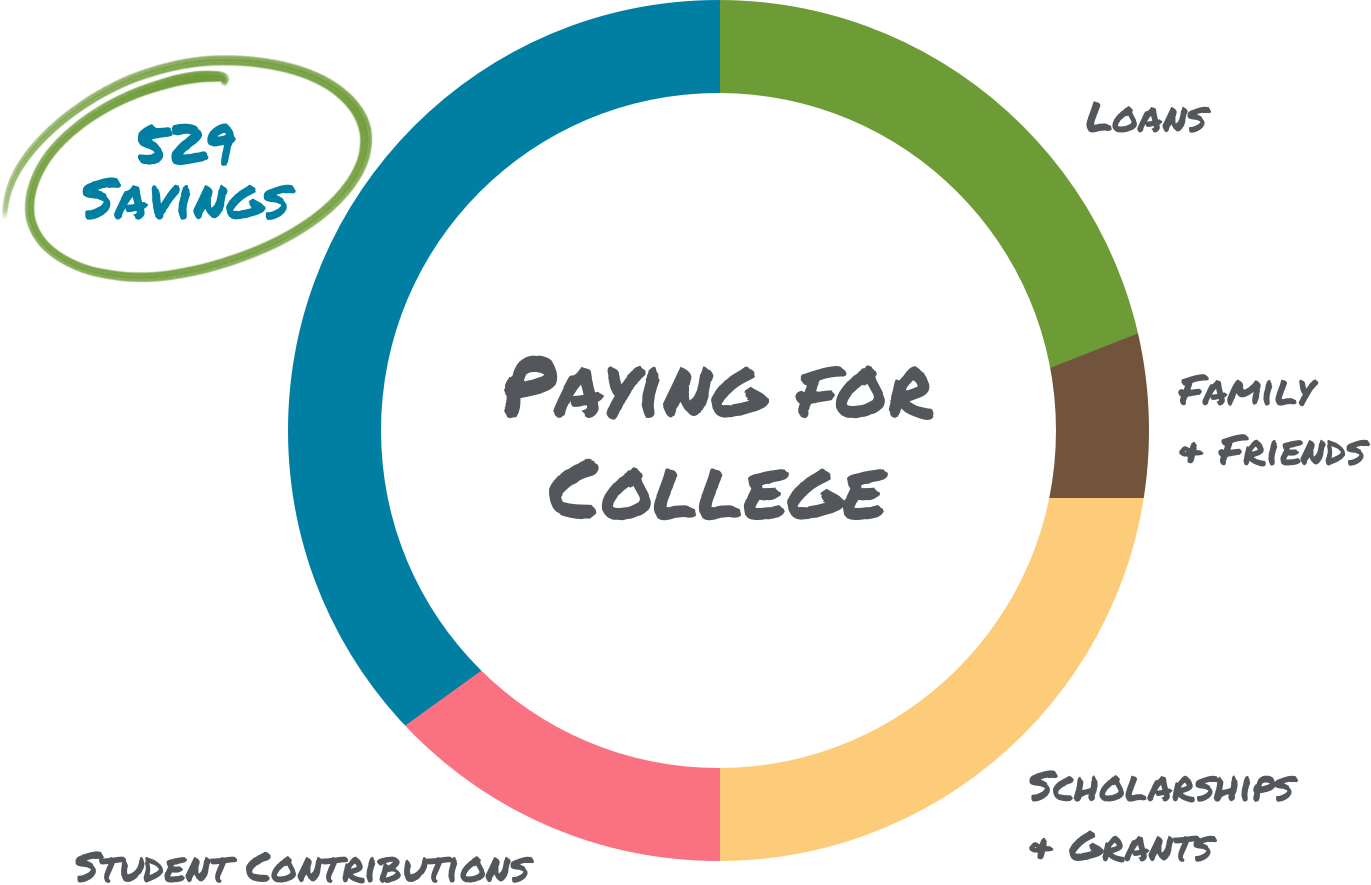

Financial Aid and 529 Plans

Impact on Financial Aid Eligibility

While 529 Plans are a great savings tool, they can affect a student’s eligibility for need-based financial aid. However, there are strategies to minimize their impact.

Strategies for Minimizing Impact on Aid

Consider using a 529 Plan in combination with other savings vehicles like custodial accounts or using them early in the student’s academic journey.

Using 529 Plans Wisely with Financial Aid in Mind

Being strategic about when and how you use 529 Plan funds can help preserve financial aid eligibility.

Tax Considerations and 529 Plans

State Tax Benefits

Many states offer state tax deductions or credits for contributions to 529 Plans. This varies depending on where you live.

Federal Tax Benefits

Federal taxes don’t apply to the earnings or withdrawals for qualified expenses, making this an attractive feature.

Tax Implications on Withdrawals

Non-qualified withdrawals are subject to federal taxes and a 10% penalty, so plan your distributions carefully.

Alternative College Savings Options

Custodial Accounts (UTMA/UGMA)

These accounts offer more flexibility but may have tax implications and restrictions on how funds can be used.

Roth IRAs

Roth IRAs provide tax-free withdrawals for education but come with contribution limits based on income.

Traditional Savings Accounts and Investments

While they offer easy access, they may not have the same tax advantages as 529 Plans.

Pros and Cons of 529 Plans

Pros of Using 529 Plans

- Tax-free growth

- Flexibility in spending

- State tax benefits

- Easy to set up and manage

Cons and Potential Drawbacks

- Can impact financial aid

- 10% penalty on non-qualified withdrawals

- State restrictions on some plans

Is a 529 Plan Right for You?

That depends on your financial goals and priorities. If saving for education is a key focus, 529 Plans can be a powerful tool.

Making the Most of Your 529 Plan

Regular Contributions and Compound Interest

Consistent contributions build the account balance, thanks to compound interest working in your favor.

Staying Invested Over Time

Don’t be quick to pull funds unless necessary. Keeping investments steady helps maximize growth.

Reinvesting Gains for Future Contributions

Any gains earned from investments can be reinvested, further growing your 529 Plan.

How to Withdraw Funds from a 529 Plan

Qualified vs. Non-Qualified Withdrawals

Only withdraw funds for qualified expenses to avoid taxes and penalties.

Penalties and Taxes on Non-Qualified Withdrawals

Non-qualified withdrawals result in taxes and a 10% penalty, so plan ahead.

Planning for Distributions Wisely

Keep track of eligible expenses and avoid unnecessary non-qualified withdrawals.

Conclusion

A 529 Plan is one of the best tools available for saving for college. With its tax advantages and flexibility, it can help families prepare for the rising cost of education. Whether you’re just starting out or have a few years left until your child heads off to school, a 529 Plan can be a valuable asset in your financial plan.

FAQs

- What is the maximum contribution limit for a 529 Plan?

Each state has its own limit, but many have high thresholds ($300,000+). - Can I use a 529 Plan for student loans?

No, 529 Plans are intended for education expenses, not student loans. - Are there income limits to contribute to a 529 Plan?

No, there are no federal income limits, though some states may have restrictions. - Can 529 Plan funds be transferred to another beneficiary?

Yes, you can switch beneficiaries to another family member without penalties. - What happens if my child doesn’t use all the money in the 529 Plan?

You can transfer the remaining balance to another family member or face taxes and penalties on non-qualified withdrawals.